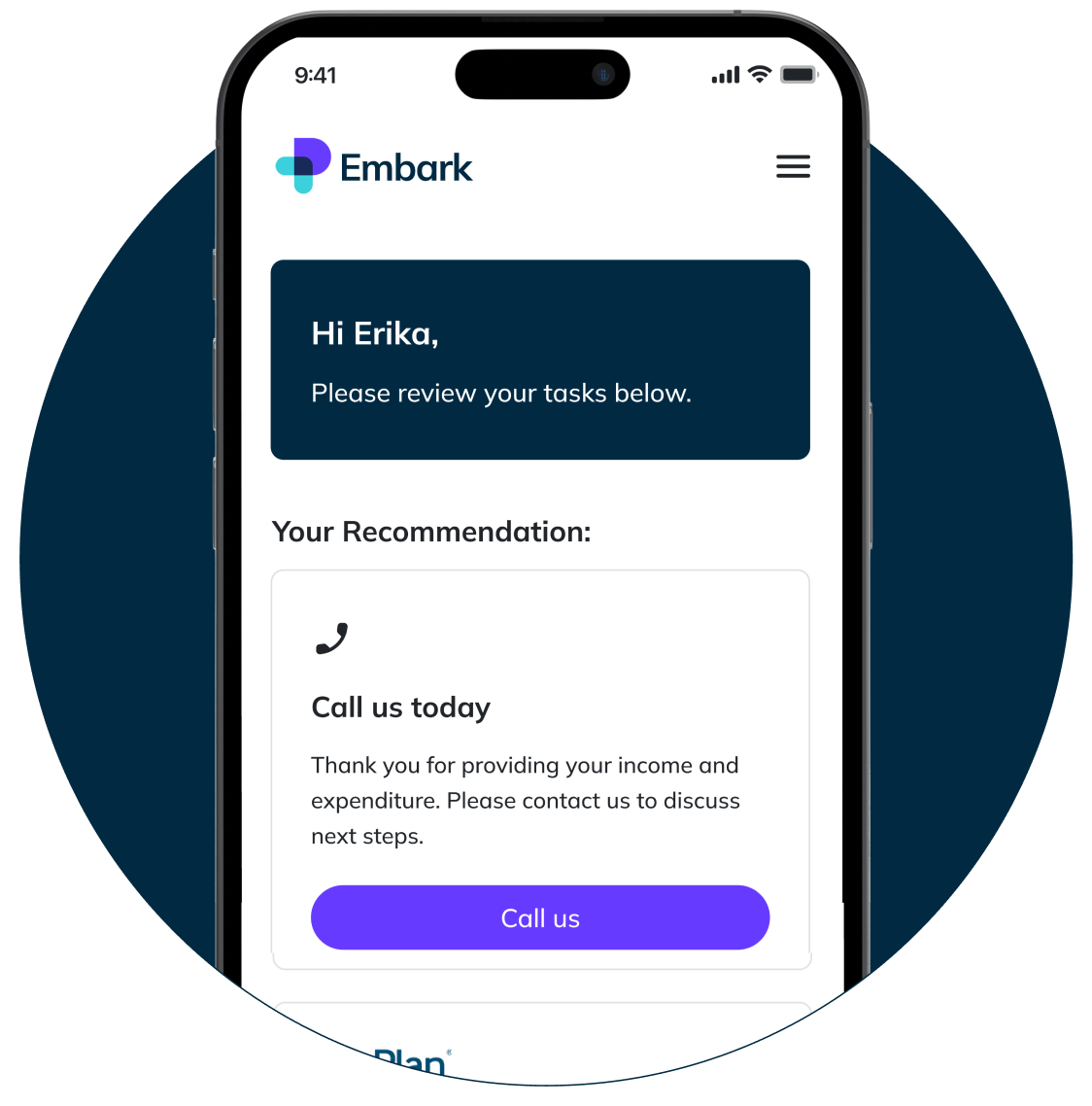

Embark is easily integrated by design. It can be embedded into any system or process such as websites, banking, apps, email/SMS campaigns and even entire case management systems. Or, if you prefer, Embark can stay separate from all of your existing platforms.

Integrating Embark into your existing CRM is a quick, straightforward process. Embark has been formulated with industry-leading management software in mind, so data can be shared between existing platforms seamlessly via APIs. Once set-up has been finalised, data sharing will be automated between your various applications.