OSB Group has entered into a multi-term partnership with fintech Paylink Solutions. The new partnership demonstrates best practice within the mortgage lending sector around understanding customer affordability and making it easier for customers to engage with OSB.

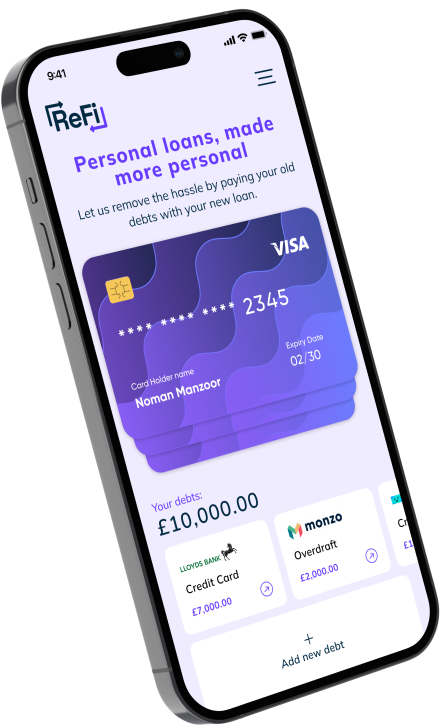

Utilising Paylink’s Embark application and using open banking, customers will be able to pre-populate their budget using the Embark application. Through its multi-brand functionality, OSB Group have affordability workflows in place for five lending brands and will utilise Embark’s data end points to automate the assessment process and tasks.

Further specialist support will also be available through Embark’s unique integration with free debt advice provider PayPlan. This means customers needing free debt advice will be able to access PayPlan’s support through a wide variety of channels, including Live Chat or via a call back. With consent, PayPlan can access a customer’s income and expenditure (I&E) information and review their financial circumstances in real-time, making the process of getting debt advice as seamless as possible.

The Embark system is multifunctional and staff will have access to all its elements. This isn’t limited to a digital-only experience as Embark can be utilised by agents when going down the more traditional call route still required by some customers.

Andrew Alder, Director of Development and Partnerships, Paylink Solutions, said of the new partnership: “We’re delighted to be working with OSB Group who have made a significant investment in supporting their staff and customers – as the impact of increasing cost of living on consumer’s increases, this couldn’t have been done at a better time.”

Tony Botteley, Group Director of Collections and Servicing, OSB Group added: “Embark has helped us streamline our processes and better understand our customer’s individual needs, while improving operational efficiency. The integration of free debt advice was a particularly important factor, given the current economic climate and helps us offer our impacted customers tailored support.”