Collaboration is no longer optional

Ofgem’s recent Consumer Vulnerability Strategy discusses how vulnerability cannot be achieved in isolation. True progress requires a cross-sector, collaborative approach—spanning energy, water, telecoms, financial services, banking and beyond.

The energy market needs change when it comes to vulnerable customers and to provide tailored support, unique to each individual that needs it. Several sectors have already been through a steep learning curve of how to change their processes to better support those in need, such as financial services, banking and water, they all now offer their own schemes to better support vulnerable people. And the energy market can now learn from those experiences.

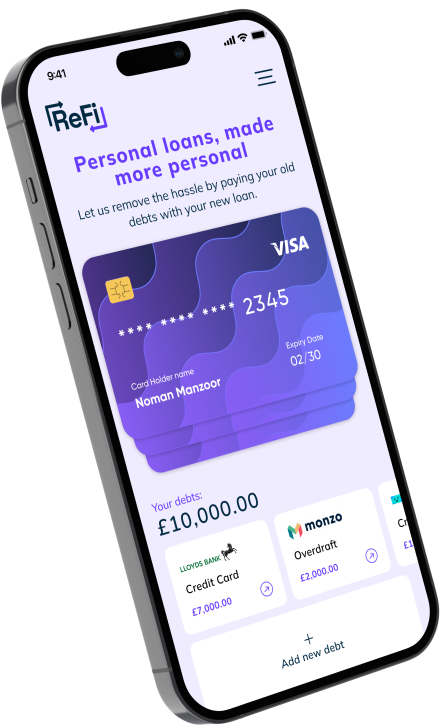

One enabler of this collaboration has been the rise of the Income & Expenditure (I&E) tool. Paylink has partnered with several tier one banks, building societies, utility companies, and financial services providers who have streamlined their affordability assessment processes with I&E tools like our Embark platform.

Cutting across siloed support – seek help from other sectors

Ofgem are urging energy companies to work with others to solve issues that cut across sectors (CVS 2025, p. 28). Vulnerable customers have bills across multiple sectors, who they interact with separately. One way that a customer can have a consistent discussion with their creditors is through an I&E tool, like Embark. By completing an affordability assessment they can port to it other creditor providers, to have tailored discussions about meeting their payment needs.

Currently, each discussion requires separate hardship disclosures which can potentially lead to:

- Consumer stress and disengagement

- Delays in accessing support

- Inconsistent interventions

- Duplication of effort

The Consumer Vulnerability Strategy is urging cross-collaboration with other sectors as part of its overall ethos in supporting vulnerable customers.

How a Common I&E Approach Can Help

| Benefit | Impact |

|---|---|

| Single Disclosure | Consumers share circumstances once—assessment recognised across sectors. |

| Faster Support | Immediate checks for schemes like Warm Home Discount, WaterSure, social tariffs, broadband affordability schemes. |

| Reduces Stress | Vulnerable individuals aren’t traumatised by repeating hardship stories. |

| Efficiency Gains | Providers trust verified assessments rather than manually repeat the process to gain accuracy |

Raising service standards: from reactive to proactive models

Raising standards within the energy sector, can be powered by implementing technologies such as I&E tools into affordability assessments; the industry can then see a shift from:

- passive service to proactive vulnerability identification

- isolated interventions to holistic consumer protection

- fragmented support to true single customer journeys

Paylink’s Embark platform can offer energy companies the ability to streamline its affordability assessments, by using third party data from sources such as open banking, credit reference agencies, it can significantly reduce completion times of filling in assessments. Once complete, an assessment can be transferred, with consent, to Paylink’s free debt advice partner – PayPlan. Keeping the customer within the journey, and signposting to effective, free advice.

This aligns with Ofgem’s Consumer Confidence strategy—measuring success by trust, compassion, and transparency.

From strategy to reality – it starts with collaboration

The Ofgem CVS 2025 is bold, urgent, and achievable—but only if the energy sector builds bridges beyond its own walls. Income & Expenditure tools offer the mechanism to do just that, and we can help facilitate those conversations. By embracing shared affordability assessments, the energy sector can lead the way toward a fairer, stronger, more human-centred future for vulnerable consumers.